Well-th Blog

Rooting for Good News, Knowing the Fed will Stay Aggressive

By Hightower Advisors / July 18, 2022

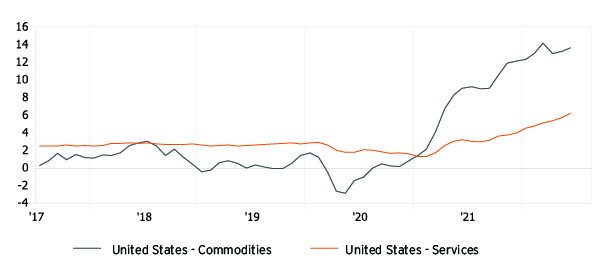

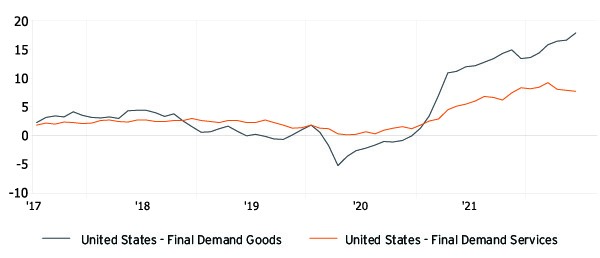

- 9.1% CPI, 11.3% PPI. Despite a consumer shift from goods to services, goods inflation continues to be a driver of overall inflation. Within CPI, food is up 10.4% y/y, energy up 41.6% y/y and all other commodities are up 7.2% y/y. On aggregate, consumer commodity prices are up 13.6% y/y and services prices are up 6.2% y/y. Similar trends are seen for producer prices, with goods up 17.9% y/y and services up 7.7% y/y.

Chart 1: Rising CPI – Commodities and Services1

Chart 2: PPI – Rising Goods, Elevated Services2

Services is a larger component of GDP and prices tend to be stickier – driven in part by rising wages and rents. Commodity prices have also been sticky as persistent shortages in energy and agriculture are a growing risk to the global economy. Emerging markets are struggling to afford essentials, while food and energy inflation are eating into a larger percent of consumer wallet share.

U.S. inflation is at its highest since 1981 – when P/E multiples were single digits. Opportunities are surfacing, with 105 names in the S&P 500 trading below 10x forward earnings.

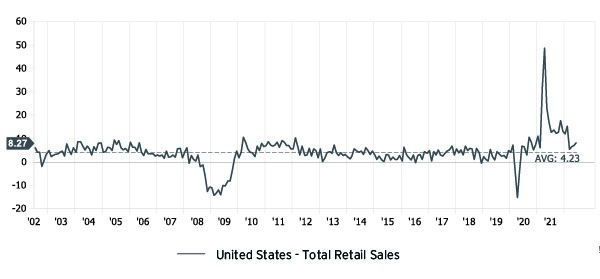

- Better Consumer Sentiment and 8.3% Retail Sales. Retail sales remained elevated in June, up 8.3% y/y and slightly negative (-0.1%) m/m. Retail sales have been resilient, with exceptions from autos and electronics and appliances.

Chart 3: Retail Sales Remains Healthy; Staying Elevated and Normalizing3

The University of Michigan consumer sentiment inched higher in July from its record lows in June. While better consumer data supports continued Fed rate hikes, we root for the consumer. Consumer spending is important for economic growth in the face of the Fed tightening.

- Earnings Growth Expected to be Led by Energy, Dragged by Financials. The S&P 500 is projected to grow earnings 4.8% y/y and grow sales 10.6% y/y in Q2. Ex-financials, earnings are expected to grow 12.3% y/y and sales to grow 12.8% y/y. Energy is expected to account for 45% of S&P 500 sales growth in Q2. We’ve regularly stated earnings downgrades as a market-risk, but so far, downgrades have lagged the historical average pace.

Themes across financials have included lower investment banking revenues, strong trading revenues, and setting aside additional reserves for potential loan losses and impairments. Y/Y earnings fell across J.P. Morgan (JPM), Morgan Stanley (MS), Citigroup (C) and Wells Fargo (WFC), which all reported last week – Citigroup was the only name to beat earnings expectations.

- CPI Points to 75 bps at July FOMC Meeting. White hot CPI data released increased the likelihood for another 75 bps hike at the FOMC meeting later this month. James Bullard, the most hawkish of voting members, raised the idea of 100 bps at the July meeting, saying the Fed could “do 100 basis points here and less in the other three meetings of this year.” Whether it’s 100 bps or 75 bps, we are confident that the Fed will continue hiking aggressively for at least the next couple of meetings.

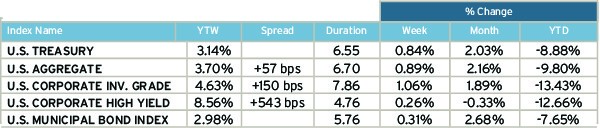

The Treasury curve flattened significantly throughout the week; the 3-month/10-year spread tightened to +56 bps after starting July at +132 bps. Corporate spreads remain elevated for the year; however, both Investment Grade (+174 bps) and High Yield (+565 bps) remain far from the extremes seen during March 2020 (800+ bps for HY). Municipal yields ended the week 4-5 bps lower across the curve.

- Amazon Shrinks Private Label Business. Citing weak sales and regulatory scrutiny, Amazon (AMZN) has drastically reduced its number of private label products. Amazon’s private-label business spans a wide variety of product lines, from food and beverages to furniture and appliances. Regulators have questioned Amazon for tactics related to favorably positioning its own products against other sellers on its platform. Amazon has said that it competes fairly, supporting nearly two million small- and medium-sized businesses on its platform.

- Comments from Alphabet (GOOGL). The strong U.S. dollar, rising wages and slowing ad revenues have impacted growth across the tech sector. Various big tech firms have either slowed hiring or begun reducing the size of their workforce.

Last week, Alphabet Inc. CEO, Sundar Pichai, released an 8-K public filing that addressed the pace of future hiring and investments. Pichai said that future hiring will slow because of the strong progress in hiring through the first half (adding 10,000 new employees). Pichai also emphasized a need for a “more entrepreneurial” mindset that re-evaluates priorities and the deployment of resources. CEOs are communicating a more challenging environment on the horizon, a sharp contrast to the extraordinary bull market of the past decade for tech.

- The Week Ahead.

Earnings – Monday: BAC, GS, IBM. Tuesday: JNJ, HAL, NFLX, LMT. Wednesday: BKR, TSLA, CSX. Thursday: DOW, T, UNP, AAL, DOV. Friday: AXP, VZ, NEE, SLB.

Econ – Monday: NAHB Housing Market Index (July). Tuesday: Building Permits, Housing Starts (June). Thursday: Philadelphia Fed Index (July).

Stephanie Link: CNBC TV Schedule

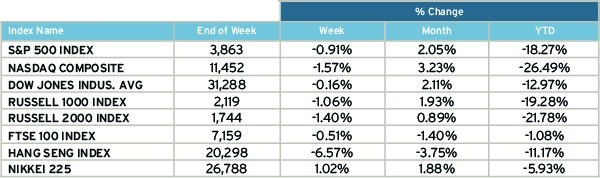

Return for Selected Indices4

Sources

- FactSet (chart)

- FactSet (chart)

- FactSet (chart)

- Bloomberg

Disclosure

Investment Solutions is a group of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC, and with Hightower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through Hightower Securities, LLC; advisory services are offered through Hightower Advisors, LLC.

This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors.

All data and information reference herein are from sources believed to be reliable. Any opinions, news, research, analyses, prices, or other information contained in this research is provided as general market commentary, it does not constitute investment advice. Investment Solutions and Hightower shall not in any way be liable for claims, and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice.

This document was created for informational purposes only; the opinions expressed are solely those of Investment Solutions and do not represent those of Hightower Advisors, LLC, or any of its affiliates.

Hightower Advisors is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.