Well-th Blog

Bigger, Faster, Stronger

By Hightower Advisors / April 7, 2022

Rate Hikes: Bigger, Faster

Fed Governor Lael Brainard recently made hawkish comments that indicated a front-loaded rate hike cycle and rapid balance sheet runoff. We interpret this as the Fed’s attempt to communicate and warn markets of an impending 50 bps rate hike in May, and a reduction in Treasury buying. Currently, as bonds mature, the Fed reinvests those proceeds back into Treasury or mortgage securities. Forgoing reinvestment is a form of quantitative tightening, and along with rate hikes “will contribute to monetary policy tightening over and above the expected increases in the policy rate reflected in market pricing”, said Brainard.

According to Bloomberg, 92% of economists forecast a 50 bps hike in May, compared to just 52% at the beginning of March. Economists are forecasting a total of 200-225 bps magnitude of rate hikes by year-end. Rate hikes are bigger and faster than previously anticipated, in part because consumer and company balance sheets are stronger.

The rate hikes directly impact the effective fed funds target rate, which is the intra-bank lending rate. This rate is then passed through into other lending securities, which include a spread for additional risks. The objective for the Fed is to slow the pace of inflation while maintaining a healthy jobs market, economic growth and price stability – if they are able to execute this, it will be only the second time in the history of Fed tightening policy that does not result in a recession.

While rate hikes and reduced buying does increase the cost of borrowing, it does not transport ocean freighters more efficiently. It does not increase the supply of oil. It does not push pandemic retirees to return to work. We are seeing positive momentum in supply chains and expanding business activity that we anticipate will contribute to a long runway of elevated GDP growth ahead (in addition to healthy consumers). It is these factors that add conviction amongst both Fed members and our team that the economy can handle higher rates; inflation is the biggest priority because it is the biggest risk to the economy.

Consumer Data: Stronger

Nonfarm employment increased +431,000 jobs in March, remaining above trend and led by services – particularly leisure and hospitality, and professional and business services. The report also included an hourly earnings number that increased +5.6% y/y. The unemployment rate is down to 3.6% and job openings are 11.3 million. Jobs demand is significant; those who want a job can find one and they will get paid more for that job.

Service industries led the job report, particularly leisure and hospitality, underscoring our emphasis on reopening themes where significant pent-up demand remains strong. In fact, the March ISM survey, a leading indicator, highlighted healthy expansion across both services (58.3) and manufacturing industries (57.1). Survey respondents shared commentary on continued business and demand strength with elevated backlogs, yet supply chains remain unstable and labor continues to push costs higher. Lastly, shipment of core capital goods increased +15.6% annualized in Q1, emphasizing demand-driven business activity and a focus on supply chains and inventory to help meet that demand.

Commodity Inflation: Bigger

Commodity inflation is widespread and impacting nearly all industries. Unlike the stickier components of inflation like wages and rental costs, which we expect will continue to drive inflation for longer, commodity inflation was largely expected to resolve in 2022 on the basis of easing supply chain challenges and a shift of consumer preference from goods to services (remember transitory ?). While this still is expected to take form at some point, higher prices for commodities continue to place outsized, upward pressure on business and consumer costs, alike.

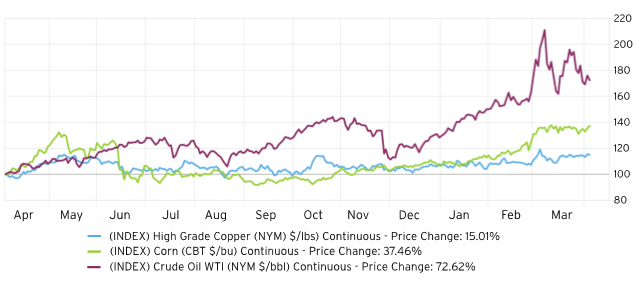

Over the past year, copper, corn and oil continuous futures are up 15%, 37% and 73% respectively. The price of oil impacts just about everything, from the price you pay to fill up your car to anything that requires moving goods (freight) or humans (airlines). Corn is a common ingredient across foods and beverages, greatly impacting the consumer staples industry. Copper is a key input for industrials and rising prices tend to indicate a strong economy as demand for autos and investment in homes and businesses relies on copper as a key input towards electrical machinery, shelter and auto parts.

Chart 1: Commodity Continuous Futures Prices1

It is for these reasons that the equity market is a beneficiary of, and hedge towards, inflation. Businesses have been able to raise prices, maintain margins and grow profits from the inelastic demand environment. Inflation generates opportunities across industries and companies that are able to exhibit pricing power.

We see outsized opportunities among energy, materials and industrials. Energy and materials benefit from the increasing demand for their goods at higher prices. Energy stocks were the first-mover in 2022, rising near 40% in Q1. Materials have increased +6.4% in the past month – the second-best performing sector to consumer discretionary over that time horizon.

A key theme across many of our industrials selection is automated-intelligence (AI)-providers and capex beneficiaries. Data is an exponentially growing commodity for businesses seeking to become more efficient and intelligent amid supply challenges. Supply challenges are impacting the ability for businesses to not only stock inventory, but also to expand capacity physically – making available AI technology incredibly valuable. Companies have enabled AI to aggregate data and leverage machine learning to improve efficiency and reduce costs for businesses. As inflation presents a growing risk to the consumer, B2B services could benefit from a large capex cycle ahead. In an economy with elevated growth and inelastic demand, we’re seeking companies that benefit from the reopening, pricing power and unique AI-based services.

Stephanie Link: CNBC TV Schedule

Sources

- FactSet (chart)

Disclosures

Investment Solutions at Hightower Advisors is a team of investment professionals registered with Hightower Securities, LLC, member FINRA/SIPC, & Hightower Advisors, LLC a registered investment advisor with the SEC. All securities are offered through Hightower Securities, LLC and advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee. In preparing these materials, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public and internal sources; as such, neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Hightower shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates.

Hightower Advisors is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.